More Detailed Explanation of NJ's Electric Rate Increases

The NJ Electrification Coaching Network provides an explanation of the pricing process, so that you may better understand our recommendations

A previous article discusses the announced rate increases for electricity here. This article explains the rate-setting process in more detail, but assumes that you have read the previous article.

Note that electric rates are not the only energy whose price is increasing. The US Energy Information Agency also expects natural gas prices to rise as well, from $2.20/MMBTU in 2024 to $4.60/MMBTU in 2025/6. This could add approximately $0.20 per therm to the natural gas rate over the year which could result in an increase in the residential natural gas rate:

Despite a net injection into storage during March, U.S working natural gas inventories ended the withdrawal season (November–March) 4% below the five-year average as cold weather in January and February resulted in more natural gas than average being withdrawn from storage. Consequently, we expect higher natural gas prices this year, with the Henry Hub price averaging around $4.30 per million British thermal units (MMBtu) in 2025, up about $2.10/MMBtu from 2024. We expect the annual average price to increase another 30 cents/MMBtu in 2026 to around $4.60/MMBtu.

The remainder of this article contains a more in-depth description of the energy pricing process. We have tried to provide enough explanation so that any individual can assess the claims made by various parties in this debate.

The operation of the competitive electricity market is a set of complex rules run by a small group of clublike participants. But the more we understand it, the more we can change it to be cleaner and more renewable from the inside out.

Organizations That Are Involved in Regulation

There are a number of stakeholders involved in setting the supply side price. The supply side is also called the wholesale market. The supply side makes up 60% of a customer’s electric bill. The remaining 40% is the distribution side, also called the retail market.

PJM and other Regional Transmission Organizations

PJM is an organization of the utilities in all or parts of 13 states - PA, NJ, MD, (hence the name), as well as DE, IL, IN, MI, NC, OH, TN, VA and WV - that determines which power generators will come online and which can be decommissioned. PJM plans for future demand and supply and runs the auctions that determine the prices that will be paid for units of electricity, and who gets to supply that electricity. PJM is a Regional Transmission Organization (RTO). Similar organizations are CAISO (CA), ERCOT (Texas), ISO-NE (New England) MISO (Midwest), NYISO (NY), and SPP (Southwest). While some of these organizations were established as early as the 60’s, they were created as RTOs by FERC during deregulation of the power industry in 1990’s and their rules attempt to mimic a free market for energy, overlaid with planning.

They also run the day-to-day and minute-by-minute operation of the power grid.

PJM is an independent organization with a board that manages the transmission system. They are a member based organization. Their voting members include generator owners, transmission owners, electric holding companies, utilities, buyers and sellers of electricity, State Rate Counsels and consultant in the energy industry.

80% of the voting membership of PJM are electric holding companies, generation owners, transmission owners, electric utilities and the buyers/sellers of electricity. Rate Counsel, representing the electric customers, get 20% of the vote. State utility commissions are not voting members.

Boards of Public Utilities (NJ BPU)

NJ BPU is the regulatory and energy policy setting body for NJ utilities. NJ BPU has no control over energy or capacity pricing in PJM. In order to implement energy policy, it also requires utilities to have certain energy efficiency programs. The NJ BPU is not a PJM member.

Rate Counsel

This is a NJ state agency that is responsible for representing the interests of residents, businesses, and other ratepayers in all NJ BPU utility proceedings. It is a party to every proceeding before the BPU and is also a PJM voting member.

FERC (Federal Energy Regulatory Commission)

FERC is a federal regulatory agency that oversees and sets the rules that PJM and other electric RTO must abide by, but PJM sets its own procedures and manuals for its operations - subject to FERC approval and oversight.

Electric Utilities (called Electric Distribution Companies (EDC))

Utility companies, e.g. Public Service Electric and Gas (PSE&G), run the business of maintaining the distribution lines and connections to customer premises, and perform customer administration and billing. They provide their customers with the energy whose price has been set by the PJM auctions. Under deregulation, utilities cannot own generation facilities or transmission lines. They are PJM voting members.

Electric Holding Companies

Electric Holding Companies, e.g. Public Service Enterprise Group (PSEG - no &) own generation facilities, transmission facilities and electric utilities as well as other electric services such as the buying and selling of electricity. They are PJM voting members.

Paying for Capacity and Paying for Energy

The price of supplying electricity is determined both by

(~75%) buying the energy that is actually used, and by

(~15%) buying capacity, i.e. paying utilities simply to stand-by, with some amount of energy generation capacity, in case it is needed during peak. NJ currently needs a peak energy capacity of approximately 17 GW in the summer and a bit less than that in the winter. (The remaining 10% are for other services.)

Changes to capacity prices are the primary cause of the current large increases.

Buying Capacity

There is a capacity auction every July run by PJM, formally known as the Reliability Pricing Model - Base Rate Auction. PJM asks each of the utilities for a forecast of the energy that will be needed in 3 years. They compile the data into a forecast of peak energy demand, and conduct an auction open to all electricity generating sources, asking them to bid a price and quantity of electricity that they can guarantee to supply when called on during the peak. This auction ensures that there is dependable supply of electricity to meet the peak but also the pricing signal, so that generation (capacity) is built and operational.

When the auction is closed, PJM selects enough bids, in lowest price order, to supply the highest peak of demand, plus a reserve amount above peak, for three years into the future. This is the clearing price and all generators are paid this clearing price regardless of their lower bids. The energy suppliers are then paid every day to be ready to produce electricity up to the maximum that they agreed upon clearing price, whenever it may be needed. There are large financial penalties if a supplier has been paid to supply capacity, and can’t do it when needed.

Of course, if PJM hasn’t approved enough new suppliers (aka generators) and/or the suppliers haven’t built the capacity they were approved for, or if the forecasts are wrong or if the auction isn’t held sufficiently in advance to allow power suppliers to react in time, then the limited set of suppliers that ARE ready get to determine the price. The law of supply and demand kicks in, and prices can escalate rapidly, which is what happened now in PJM. (In April, the NJ Rate Counsel has called on FERC to invalidate the most recent auction and investigate price fixing, as reported by Utility Dive, the industry newsletter.)

Usually, renewables don’t bid in the capacity auction, since they cannot deliver energy on demand, but only when conditions allow them to be available. In other words, they are variable and NOT “firm capacity”. If solar and wind do get approved to be capacity resources, their capacity will be limited by a factor that accounts for their variability. So they are not competing with more traditional types of generators in this market. This factor is call the Effective Load Carrying Capacity (ELCC). The ELCC can also reduce the capacity of older inefficient generators like coal and older natural gas plants that have a track record for lower response when called on during peak.

Critics of clean energy often blame renewables for driving “firm capacity” out of the market, because renewables are less expensive due to zero fuel costs. The capacity auction is intended to address this issue by compensating “firm capacity” generators to stand by for overall reliability. And if a generator announces an intended closure (or “retirement”), PJM can delay the retirement by declaring the generator as a needed “must-run” resource and pay it extra compensation. As someone commented, this is nice work if you can get it. Most of the must-run plants only run for a few days a year. Note that PJM is reporting 40 GW of power as retiring, which is mostly coal, but only 12 GW of that has actually filed for retirement.

Demand response programs that lower the peak demand, like utility thermostat management programs or distributed solar, can lower demand overall and lower capacity and energy prices for everyone.

Buying Energy

Buying the energy that is actually used happens daily in the day ahead auctions. Power generators receive a forecasted load from PJM at 3PM every day, and it depends on weather, plant outages, etc. Generators bid a price and amount, based only on their operating costs. The marginal cost to produce energy. All generators can bid even if they did NOT bid into the capacity auction. However, any generator who was chosen in the capacity auction MUST bid in the day ahead energy auction, to prevent capacity subsidies to generators who don’t actually ever contribute energy, although they don’t have to submit a winning bid. The winning bids are selected into a “merit order” determined by price, with lowest price first.

In the minute-by-minute operation of the grid, generators are brought online (or shut down) in “merit order” as actual demand occurs. The price that is paid to all suppliers is the highest price that any of the active actual suppliers bid. This is called the clearing price. Therefore, any method used to lower the amount of energy that is needed could dramatically lower the price for everyone. Conversely, any spike in energy could dramatically raise the price for everyone.

Some generators that have capacity rights may be limited in what they can bid into the energy day ahead market. The cap on their maximum capacity is based on the ELCC. These facilities can only supply energy up to their cap determined by the ELCC. These facilities are solar, wind, battery storage, inefficient coal and natural gas plants and generators that had prior operational problems.

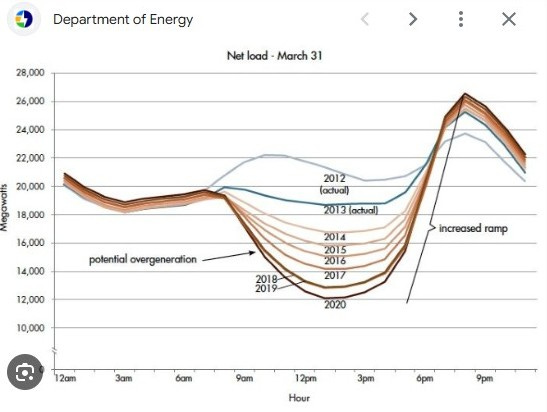

Solar and wind capacity is discounted by more than 20% of its maximum capacity so they contribute less than their maximum energy. But because the energy market is based on operating cost, solar and wind can supply their energy at lower costs. This causes other higher energy cost generators to be out of the merit order. It’s good for consumer energy prices. But these higher energy cost generators have higher ELCC and contribute more during peak. These reasons are why renewables can be difficult to integrate into a power grid. They can also cause sudden increases or decreases in available power and other “firm” resources must compensate just as suddenly. This phenomenon is called the “duck curve”.

Note that residential rooftop solar power and community solar installations ARE NOT part of these auctions. To the RTO, they simply look like the homeowner is using less electricity, thereby reducing the peak demand, helping to hold down the price. Utility-sized large solar projects ARE part of the auction, and because they have zero-cost fuel and therefore a very low operating cost, they are able to bid at very low prices, and will be chosen to run in whatever time slot they bid. Other larger combustion generators like coal or natural gas with higher fuel cost may then not be chosen during the day ahead bidding process because of their higher operating cost, and will run less of the time. However they are already being paid for their capacity to be available, described above, in order to keep them from closing down.

Some critics note that some types of energy receive subsidies, and can skew the market by allowing them to bid lower prices. Utility scale solar is subsidized by selling SRECs (Solar Renewable Energy Certificates), which are issued by the utility for every megawatt-hour (MWh) of energy produced, and which can be bought to meet the renewable energy portfolio standard (RPS) requirements. Sometimes nuclear plants are subsidized with zero emission credits (ZECs - same idea) or a small production tax credit payment per kWh from the Inflation Reduction Act. In many states, nuclear is subsidized directly or the plant would close. But fossil fuels sometimes also receive subsidies - WV subsidizes coal and PA subsidizes natural gas. And fossil fuels have received many types of tax incentives over the years. It is hard to balance all these different types of energy subsidies to get a clear market signal.

Another exception to the “merit order” choice of energy suppliers can occur in unpredicted conditions, such as unscheduled outages of other suppliers or maximums being exceeded on transmission lines, or unusual increases in demand. Note that transmission line maximum conditions that cause price spikes will also likely signal that improvements are needed on those lines, and lead to action from the utilities.

There is also a “real-time energy market”, in case of unplanned outages or unforecast demand, in which generators can bid additional energy supplies, and they are paid even more than the price determined by the day-ahead market.

Critics also point out that a large-scale conversion of HVAC to heat pumps will exacerbate the pricing issues by increasing demand. For now and most likely for the next 10 to 15 years, the peak demand in winter, when heat pumps are used for heating, is not as high as the peak demand in summer, and therefore may not affect the capacity pricing. In summer, heat pumps use less energy than standard air conditioners and should help reduce peak energy needs.

Changes That Could Improve The Process

Changes to Auction Rules

In the past few years, capacity auctions have not been held in the promised timeframes because of changes to the auction rules. The delays have let unaddressed changes accumulate. A smaller rise in price a few years ago may have encouraged more suppliers to come online sooner, limiting the sudden rise just experienced. And auctions without sufficient forecasting time don’t let generators plan sufficiently far ahead to bring new supplies online and help to hold down the prices.

Gov. Shapiro of Pennsylvania, joined by other governors including Gov. Murphy of NJ, have negotiated some caps limiting pricing changes between auctions, but it’s not clear what effect they will have.

PJM had made recent changes to auction rules, excluding some available energy sources (some renewables and some “must-run” generation sources), skewing the results towards a shortage of supply and therefore raising the resulting prices. Litigation has forced PJM to address these issues in the next auction.

Changes to Review Procedures for the Queue of Proposed Interconnections

PJM has a huge queue of projects that have requested but not received reviews. Utility Dive, an industry magazine, states on April 10, 2025, that 145 GW was in PJM’s review queue, and it would take 2 years to clear it. Some projects have been in the queue for multiple years. The additional supply probably would have changed the supply/demand interactions rather dramatically in the past auction.

PJM is changing their algorithm, in response to public outcry, and is allowing 50 shovel-ready projects to “jump the queue” and proceed. This was approved by FERC, even though they are not sure that it will solve all of PJM’s slow interconnection problem. In a recent NJ state hearing (see References), PJM promised to clear this queue in 2 years.

PJM stated that there are 50 GW of approved projects that have cleared their review queue that are not yet online. The status of these projects should be examined.

See Matt Estes’ Substack (referenced below). He had worked for FERC and is calling out issues that he has seen. Here is an excerpt from his answer to one of my comments on his article1:

Interconnections are a big issue on the grid…there are two problems with interconnections. The first is that so many requests are submitted that it clogs up the system as PJM (and other RTOs and utilities) try to process them. The new rules will help with that, because it allows projects that are ready to go forward to cut in line ahead of people who haven't done the necessary development. There are some interconnection trolls who have no intention of ever building a project but submit multiple interconnection requests in the hope of being able to sell their request position to someone further behind them in line. The new rules should make it harder for the trolls to do this.

But there is a second problem with the large number of interconnection requests. The transmission system doesn't have unlimited capacity. And if an interconnection request can be granted only if new facilities need to be constructed, the project making the request is required to pay the costs of the upgrades. Sometimes the new facilities required can cost in the hundreds of millions of dollars. Not surprisingly, the more requests there are, the more quickly interconnection capacity gets used up, and the more likely that expensive upgrades will be required for new projects seeking to interconnect.

Mike Winka, retired Senior Policy Advisor at the NJ BPU, in conversations with NJ ECN, noted that there are additional changes that could eliminate some of the problems in forecasting. PJM needs to implement FERC Order 1920 to conduct and update long-term transmission planning to anticipate future needs and consider a broad set of benefits with increased states roles. One key aspect is customers should only pay for the projects that benefit them. The issue is, if a PJM state incentivizes the location of large energy demand facilities, whether the remaining states in PJM should pay for that increase need for supply and transmission. In addition to matching the long-term planning required by FERC of PJM, the NJ utilities should file Integrated Distribution Plans (IDP) to conduct and update long-term distribution planning to anticipate future increases in local load as required in the NJ 2019 Energy Master Plan. The Utilities and PJM are years behind in meeting this planning requirements. Good planning could have anticipated this demand increase.

Currently, the utility companies do not have to say who is in their demand queue - they only have to give their demand forecast. Therefore, some of the utilities may be counting the same customer more than once, especially if a large customer is considering several sites in the territories of different utility companies. Transparency would help, with some consideration of competitive business confidentiality. Requiring a down payment and a contract to use and pay for the requested electricity would eliminate capricious requests that are not serious. There are two bills before the NJ Legislature that would require new large energy users to do just that: S4143 and A5564.

Changes to Accelerate New Suppliers

There have already been changes to allow “shovel-ready” projects to jump the queue, over those that are not ready, as well as to allow different suppliers to use the same interconnection rights if they do not run at the same time, e.g. battery storage and solar farms. Additional changes to further accelerate those suppliers who can come online quickly, like battery storage and up-rating (additional capacity of existing suppliers) should be done.

Reducing usage: Demand Response, Time-of-Use Pricing, Weatherization and Efficiency

Both Time-of-Use Pricing and Demand Response are mechanisms that are already in operation on other grids in the US.

“Time of Use Pricing” means that the price of electricity varies according to the time of day, encouraging customers to shift their usage to less expensive times, therefore evening out the load and decreasing the peak load on the system. For instance, people could charge their EVs or run their dishwashers overnight. Or pre-heat or pre-cool their home before the peak demand in the late afternoon. Of course, pricing must be clearly communicated to customers, allowing them to understand how to alter their behavior.

“Demand Response” means that the utility can send electronic signals to customer equipment (with customer consent to participate) to temporarily turn off some of the electricity load, if a peak is approaching that would make everyone’s electricity more expensive. Thermostats and water heater settings could be modified by a few degrees, EV charging could be halted, etc.

Weatherization of buildings and efficiency in equipment operation also reduce the peak demand. As heat pumps are adopted and the winter peak demand increases and perhaps even surpasses the summer peak demand, weatherization will be extremely important.

Advocate For Thermal Energy Networks to be Managed by Natural Gas Utilities

Installation and operation of thermal energy networks has many similarities to natural gas plant management, and employees could easily be retrained. Gradually refocusing the gas industry toward this newer technology mitigates job losses, and facilitates finding the technical employees that this new industry will need.

References

Utility Dive, 13 Feb 2025, New Jersey residential customers face 20% bill hikes, driven by PJM capacity prices: BPU

Select Committee of NJ Senate & Assembly- DeAngelo and Smith - Hearing from 28 March 2025 on the projected electric bill increase caused by the last PJM Base Residual Auction.

Meredith Angwin, “Shorting The Grid”. Very readable book that describes grid operation and policies.

Michael Winka, conversations with the New Jersey Electrification Coaching Network.

Footnotes

1 Matt Estes Substack - Explaining The Grid: What’s Going in in the PJM Capacity Market, 13 Feb 2025. Also see the comments below the article.

Here is a report from a consulting group that analyzes PJM's data queues: https://www.synapse-energy.com/sites/default/files/Evergreen%20PJM%20Queue%20Report%204.10.25_%20final%2024-145.pdf.

This article from Utility Dive, an industry newsletter, says that if the PJM Capacity Auction was simply re-run, but included the must-run resources, which were previously included but suddenly excluded from the most recent auction, the utility price rise would be considerably less.

https://www.utilitydive.com/news/ferc-pjm-capacity-auction-ratepayer-advocates-complaint/745358/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202025-04-15%20Utility%20Dive%20Newsletter%20%5Bissue:72252%5D&utm_term=Utility%20Dive